The Schwab Avg – Implied Volatility, Call - Implied Volatility, and Put - Implied Volatility, while based on the Robert E. Whaley calculation, are derived using methods that may differ from those used by other data providers. StreetSmart Edge uses the modern calculation for Keltner Channels, which uses EMA rather than SMA as the signal. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. ( member SIPC ), offers investment services and products, including Schwab brokerage accounts.

Schwab Streetsmart Edge Login

Access to NASDAQ TotalView® is provided for free to non-professional clients who have made 120 or more equity and/or options trades in the last 12 months, 30 or more equity and/or options trades in either the current or previous quarters, or maintain $1 million or more in household balances at Schwab. Schwab Trading Services clients who do not meet these requirements can subscribe to NASDAQ TotalView for a quarterly fee. Professional clients may be required to meet additional criteria before obtaining a subscription to NASDAQ TotalView.

The speed and performance of streaming data may vary depending on your modem speed and ISP connection.

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.

Extended Hours Trading may not be suitable for all investors and poses certain risks. These risks include, but are not limited to, lower liquidity, higher volatility and wider spreads. To learn more, call 1-800-435-4000.

Direct access trading at Schwab involves additional eligibility requirements.

With long options, investors may lose 100% of funds invested. Multiple leg options strategies will involve multiple commissions. Spread trading must be done in a margin account. Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received. Writing uncovered options involves potentially unlimited risk.

Schwab Streetsmart Edge Cloud

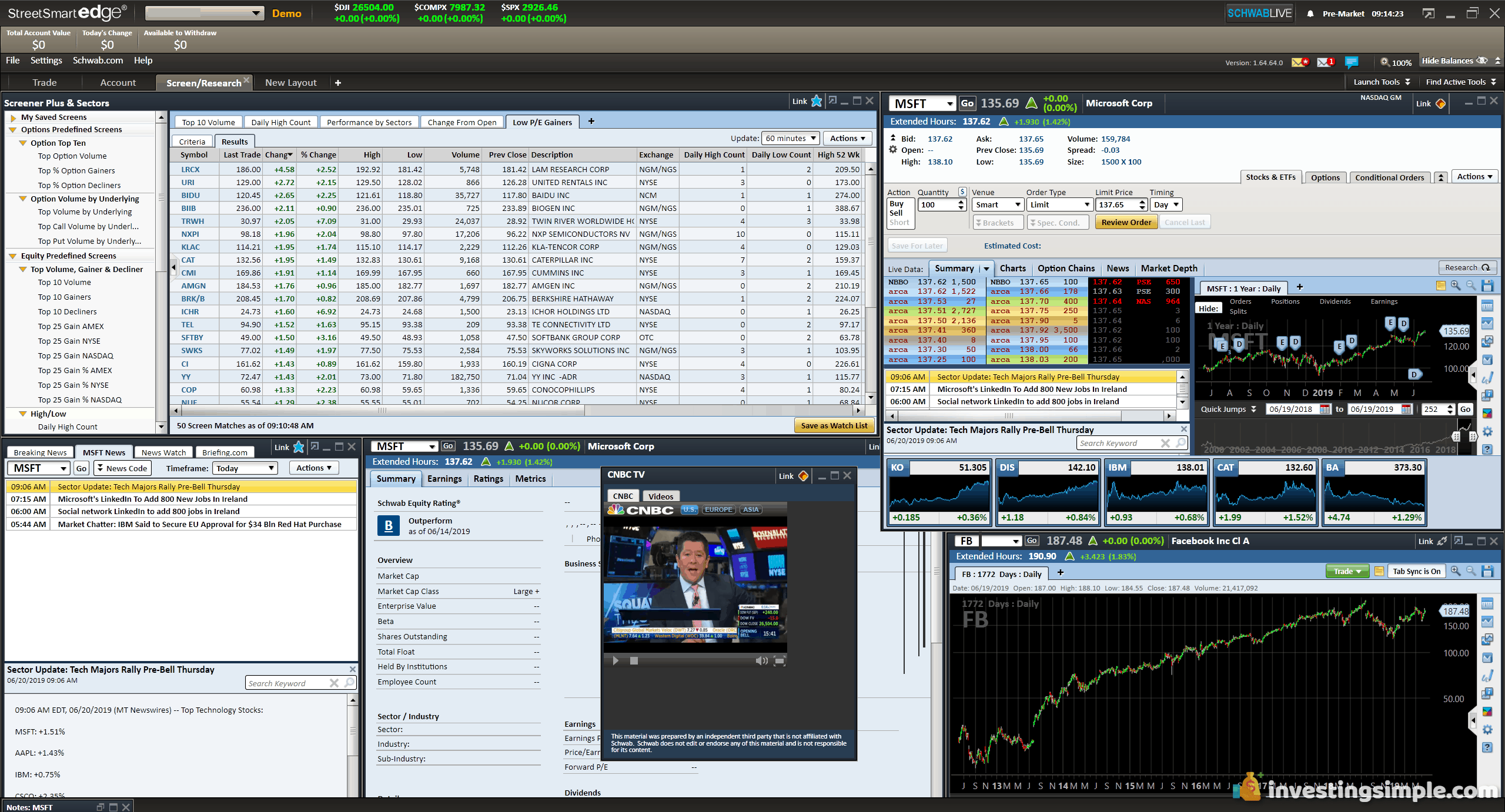

Welcome to StreetSmart Edge ®. StreetSmart Edge® is designed to think like a trader to help you take on the market. It is intuitively designed with innovative tools that work together, making it easy to use and flexible to grow with your needs, while retaining the sophistication and power you expect from a Schwab trading platform.

Schwab Streetsmart Edge Download

- Checkout my Website and click the 🔔Bell🔔 notification to get notified whenever I upload new videos💥.

- Charles Schwab StreetSmart Edge requirements To qualify as a Schwab Trading Services customer, traders simply need to keep a $1,000 minimum account balance in their regular brokerage account. Combined with $0 stock trades, this platform will prove to be a real value to many investors.